Data Science For Finance

The amount of data you have to process is growing day by day – and it’s becoming overwhelming.

With data science skills, you can organise large chunks of data into clear, structured information that reaps insightful results.

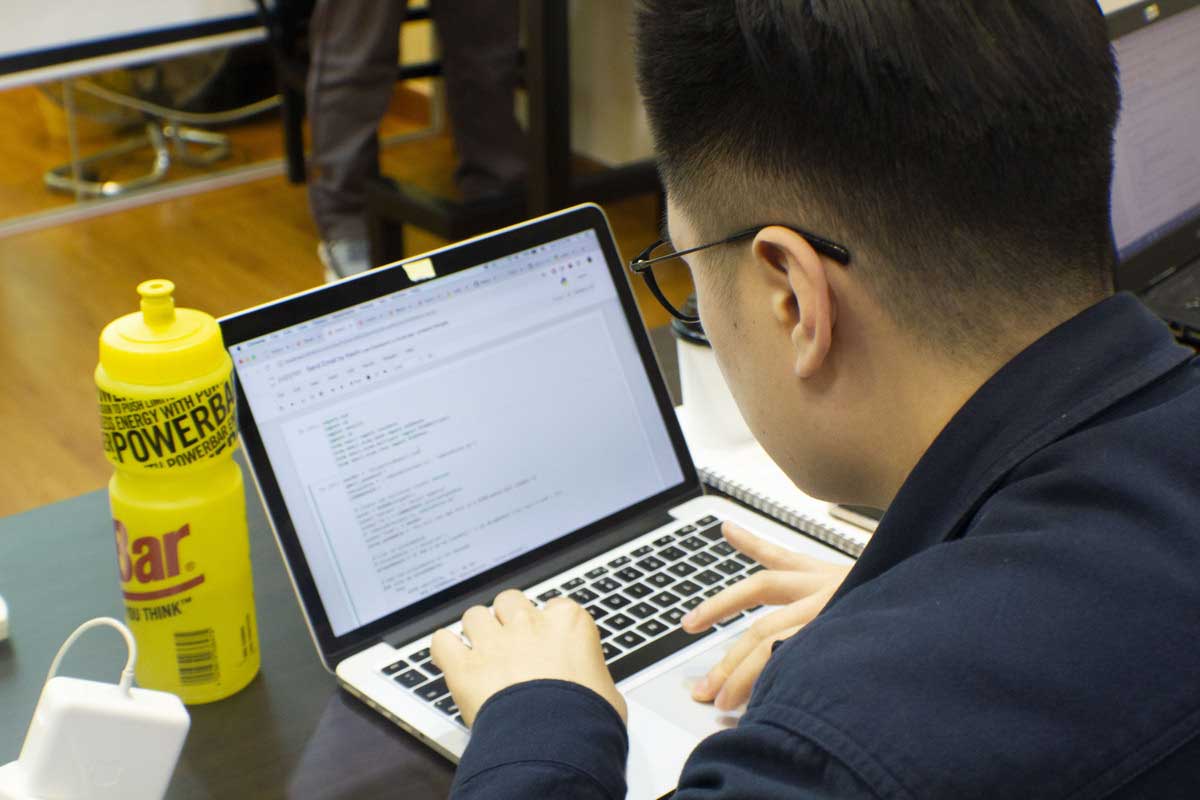

This is what Matthew Sia learnt in the past sixteen years as a financial manager. To adapt to our data-driven world, this regional finance manager of Hitachi Vantara has been developing and practicing his data science skills.

In this article, we learnt from Matthew how data science has changed the way he deals with data and how data science will become an important skill for finance professionals in the near future.

Why pick up data science?

Today, companies want to be able to forecast and predict upcoming trends to recommended customers strategies based on sound judgement.

This is why data has become a valued resource.

Large amounts of data are becoming the new norm in the finance industry. Every day, accountants and financial workers are receiving hundreds and thousands of data on transactions to build an accurate and reliable database to extra information.

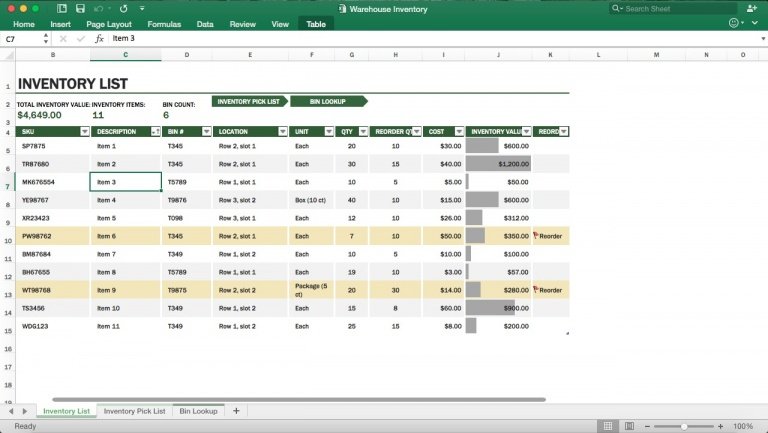

However, this can translate into tens of thousands of rows in an excel spreadsheet. Some cells may even have information that goes offscreen!

To address increasing concerns about handling increasing volumes of data, there has been a demand for more data scientists, or at least an accountant with data skill sets, in the finance industry.

It is not enough for a financial worker to know how to compile and organised data. Matthew shares that:

“…as we progress into an environment with huge amounts of data, if you don’t have the skill sets to be able to manage large amounts of data and analyse it, you’re going to be left behind.”

Matthew admits he did learn data science out of fear. But he felt like it was a natural progression in his career because he had read that data science had a lot of useful tools that can help him break down, analyse and interpret large amounts of raw data.

Within the last few years, Matthew has gotten three certifications for R on basics, visualization and probability & statistics. He also recently attended one of our Data Science 360 courses to learn python, which he remarks gave him the adequate amount of information to become a journeyman data scientist.

Matthew admits he did learn data science out of fear. But he felt like it was a natural progression in his career because he had read that data science had a lot of useful tools that can help him break down, analyse and interpret large amounts of raw data.

Within the last few years, Matthew has gotten three certifications for R on basics, visualization and probability & statistics.

He also recently attended one of our Data Science 360 courses to learn python, which he remarks gave him the adequate amount of information to become a journeyman data scientist.

The Immediate Benefits of Data Science for Finance

After picking up data science, Matthew was surprised to see how much easier for him to process and interpret data.

Using python to process a huge data-base of logistical data through stack overflow, Matthew had extracted and compiled order numbers in a clear, concise manner.

Because of this, he was able to record which order numbers had been exported and execute other similar tasks effectively.

As a trained statistician, he also has used data analytic methods like regression analysis to develop possible equations and machine learning models as well as correlation matrix to solve his company’s forecasting collection issue.

These successes had impressed his bosses. It has also given him satisfying achievement and free, driven motivation to progress further.

For example, Matthew is currently HR data to create a flight-risk assessment that can predict which team member would likely resign.

With this information, Matthew plans to take steps to prevent members from leaving and make them feel like a valued individual in the company.

One of the biggest challenges of data science is acquiring and cleaning raw data. Not only does it take long hours to collect data from various departments, but you could also get incorrect information or data that is not properly formatted.

To overcome this problem, Matthew recommends to first develop a good relationship with other departments because they are suppliers of your data.

Once a bond has been established, bring awareness in your conversations about how unformatted data can greatly affect data analysis and how they can help input data properly.

The Future of Finance: Data Conciliation and Analysis

Many companies are undergoing a period of transformation to adapt to the digital future or improve themselves.

But to know how to pick up trends, prevent pitfalls or increase profits, these companies will need people with data science and analytical skills.

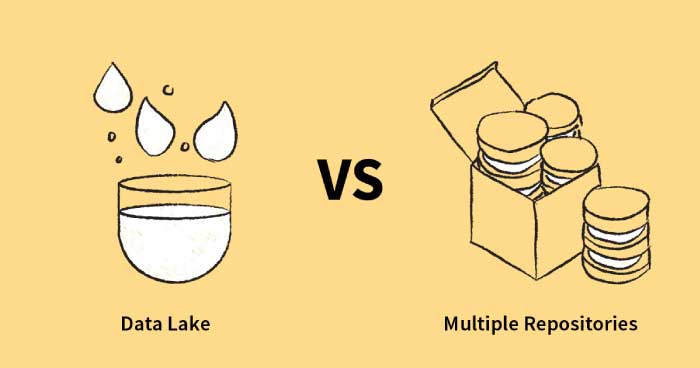

Specifically, they may be looking for data analysts who can work and develop data lake projects.

Data lake models are single-source data repositories that store all the company’s data for the entire organisation to use.

More companies are using the data lake model because it assures employees that whatever they do will reconcile and align with the existing information from other parts of the company.

Having a single source of information is also more reliable than the consolidated information from different data repositories. If there is conflicting information between repositories caused by miscalculations or misinformation, it can cause unnecessary problems.

Although putting all of the company’s data in one repository has raised safety concerns, having back-ups, offline storage and digital security measures protect data and allow it to be continuously used even when technical issues occur.

Matthew notes that most companies won’t specify they are looking for data analysis.

Rather, they will ask during the interview whether you will be comfortable with data analysis or handling large amounts of data.

They also aren’t expecting you to be an expert in Python or R, and you don’t need to know everything about data science to excel in the finance industry.

All they are looking for is someone who can make sense of the data and deliver simplified, useful information that will help the company grow in a good direction.

They don’t need detailed tables of information, they want charts that deliver the key points.

If you are applying for a senior role, employers may be looking for someone who already has strong finance and data analytic skills. But if you are aiming for a junior position, they will still hire you and give you the chance to learn data analytics along the way.

Matthew doesn’t think anyone will lose their job for not having this skill.

However, he encourages his team members to educate themselves on data analytic tools. It would let them see data in a new light, not be afraid of large data and prepare them for their future careers.

Currently, Matthew is the only one on his team with data science skills. This is because the awareness about the importance of data skills is still poor. Many of his team members are struggling to find time to learn a new skill.

You can’t force people to learn data science. If learning is forced, it is not meaningful. To convince people to take up data science skills, you have to increase its awareness about how important it is.

However, there are more and more people in the working industry that are gaining awareness and going to crash course classes to gain skills. There are even young adults who are taking up computer science courses at university.

Soon, computer science will likely be taught in mainstream education syllabus soon to prepare children for the future.

How Can I Pick up Data Science Without a Technological Background?

You don’t need to have a technological background to learn data science.

As someone who came from a non-programming background, Matthew advises readers to start their data science journey by learning a beginner-friendly programming language like Python.

Python is a user-friendly language that allows people to learn and perform the necessary, basic analytical skills. It is a language that is most used in the business world.

However, don’t worry too much about the language. Python is just a means to reach your ultimate goal, which is to process, analyse and interpret data.

As you learn how to program, create codes that you can practically use in your workplace to find purpose in your learning.

When it comes to mastering data science, Matthew recommends people to take the learning process slow and steady.

It is a common mistake excited beginners make to try and learn everything in a week. Oftentimes, they end up not learning anything because they rush to cram everything inside their heads.

Learning is not a race, but a journey. To turn coding into second nature, take time to practice, learn and get used to programming.

The process will require discipline, but Matthew remarks:

“At the end of the day, what do you want? Do you want to show people that you’re a superhuman that you can master everything in a week or do you want to master it properly and take the time that it needs?”

At the end of the day, you will not only gain data science knowledge and be able to program with ease, but you will also gain the satisfaction of building your skills from the ground up.

Once you master the basics in one language, you will be able to move on to pick up more programming languages or learn more advanced programming at a faster rate. Matthew notes that after mastering R for a few months, he learnt Python in a shorter amount of time.

Final Thoughts

Even if you enter the finance industry not expecting to learn data science, take the time to learn the necessary data science skills for your work at your own pace.

If you have friends in a similar situation, bring awareness on the importance of data science to them as well. In this way, you can all upgrade your skills as professional financiers ready for the future.

0 Comments